Debunking Myths about Structured Finance: Insights from a Boutique Investment Banking Firm

Structured finance is a complex yet vital component of modern financial markets, often misunderstood due to its intricacies. As a boutique investment banking firm, we frequently encounter misconceptions about structured finance that can deter businesses and investors from leveraging its benefits. In this blog post, we aim to debunk some of these myths and shed light on the realities of structured finance.

Myth 1: Structured Finance is Only for Large Corporations

One of the most prevalent myths is that structured finance is solely the domain of large, multinational corporations. While these entities are significant participants in structured finance transactions, smaller businesses can also benefit. Boutique investment banking firms like ours specialize in tailoring structured finance solutions to meet the specific needs of mid-sized companies and even startups. By creating bespoke financial instruments, we can help businesses of various sizes access capital markets and achieve their financial goals.

Myth 2: Structured Finance is Too Complex and Risky

The complexity of structured finance often leads to the perception that it is excessively risky. While structured finance does involve sophisticated financial engineering, the risks are manageable with the right expertise and due diligence. At our firm, we ensure that each structured finance deal is meticulously planned and executed, with thorough risk assessment and mitigation strategies in place. Proper structuring can actually reduce risk by diversifying sources of capital and creating more stable financial arrangements.

Myth 3: Structured Finance is Just About Securitization

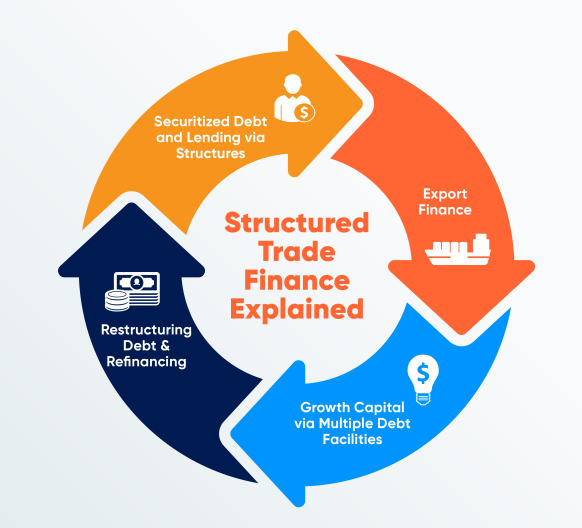

Many people equate structured finance solely with securitization, where financial assets are pooled and sold as securities. However, structured finance encompasses a wide range of financial instruments, including collateralized debt obligations (CDOs), collateralized loan obligations (CLOs), and asset-backed securities (ABS). These instruments can be used for various purposes, such as raising capital, managing risk, and optimizing balance sheets. Our firm provides comprehensive structured finance solutions beyond mere securitization, offering tailored strategies to meet diverse financial needs.

Myth 4: Only Big Banks Can Handle Structured Finance Deals

It’s a common misconception that only large, global banks have the capability to handle structured finance deals. Boutique investment banking firms like ours possess specialized knowledge and agility, allowing us to provide personalized and innovative solutions that large banks may overlook. We pride ourselves on our ability to deliver customized structured finance transactions that align with our clients’ unique requirements, leveraging our deep industry expertise and flexible approach.

Myth 5: Structured Finance is Unethical or Predatory

The 2008 financial crisis cast a long shadow over structured finance, leading to the belief that it is inherently unethical or predatory. While it’s true that some poorly structured and mismanaged products contributed to the crisis, structured finance itself is a legitimate and valuable financial practice when conducted responsibly. Our firm adheres to the highest ethical standards, ensuring that all structured finance transactions are transparent, fair, and designed to benefit our clients without exposing them to undue risk.

Myth 6: Structured Finance is Inflexible

Another misconception is that structured finance lacks flexibility and locks businesses into rigid agreements. In reality, structured finance can be highly adaptable, with terms and conditions tailored to the specific needs of the client. Whether it’s adjusting the payment schedule, modifying collateral requirements, or restructuring the deal, we work closely with our clients to ensure that the structured finance solutions we provide are as flexible as their business demands.

Myth 7: Structured Finance is Only for Distressed Situations

Structured finance is often associated with distressed situations, where companies turn to complex financial solutions as a last resort. While it can certainly be a valuable tool in such scenarios, structured finance is also used proactively to enhance financial performance, optimize capital structures, and support growth initiatives. Our firm helps clients leverage structured finance to achieve strategic objectives, not just to navigate financial difficulties.

Conclusion

Structured finance is a powerful and versatile financial tool that can offer significant benefits when used correctly. By debunking these common myths, we hope to provide a clearer understanding of how structured finance works and how it can be leveraged to achieve financial success. As a boutique investment banking firm, we are committed to delivering tailored, ethical, and effective structured finance solutions that meet the diverse needs of our clients.

Kolkata, Structured Finance, Debt, Loan, Bank, NBFC,