Leverest Finserv: Transforming Capital Dynamics for a Leading Plastic Solutions Manufacturer

Leverest Finserv, a boutique investment banking company that specializes in capital raising, has helped a plastic manufacturing company to lower its cost of debt from 12–13% to about 10%. Leverest enhanced the financial position of the client, raising its topline from INR 200 crores to INR 375 crores, by advising a strategic merger and utilizing the parent company’s balance sheet for credit appraisal. Accelerated capital raising resulted from this consolidation, which improved bank confidence, market accessibility, and serviceability.

The client, a renowned manufacturer of plastic solutions, supplies critical components to various industries for manufacturing of containers, stationary, plastic components etc. Despite its operational success, the company faced significant financial challenges that hindered its growth prospects. These challenges necessitated a strategic intervention to improve their financial health and operational efficiency.

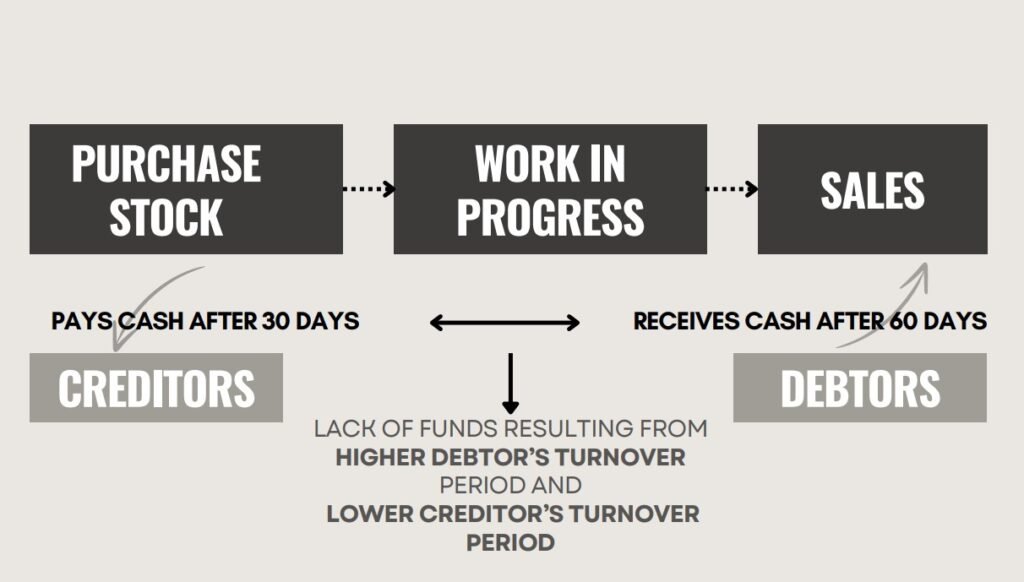

The manufacturer faced a high cost of debt, ranging from 12-13%, which strained its financial resources and limited its ability to invest in growth and innovation. Additionally, the company’s standalone financials were weak, making it challenging to secure suitable loan terms. The capital cycle presented significant issues: a debtor turnover period of 100 days contrasted sharply with a very low creditor turnover period, leading to cash flow constraints. The company’s cash accruals vis-a-vis the required loan repayments were not enough. These factors necessitated urgent working capital to sustain operations and growth, but traditional lending avenues were not yielding favourable terms due to unavailability of security collateral as well as non-negotiable terms with suppliers.

Approach-

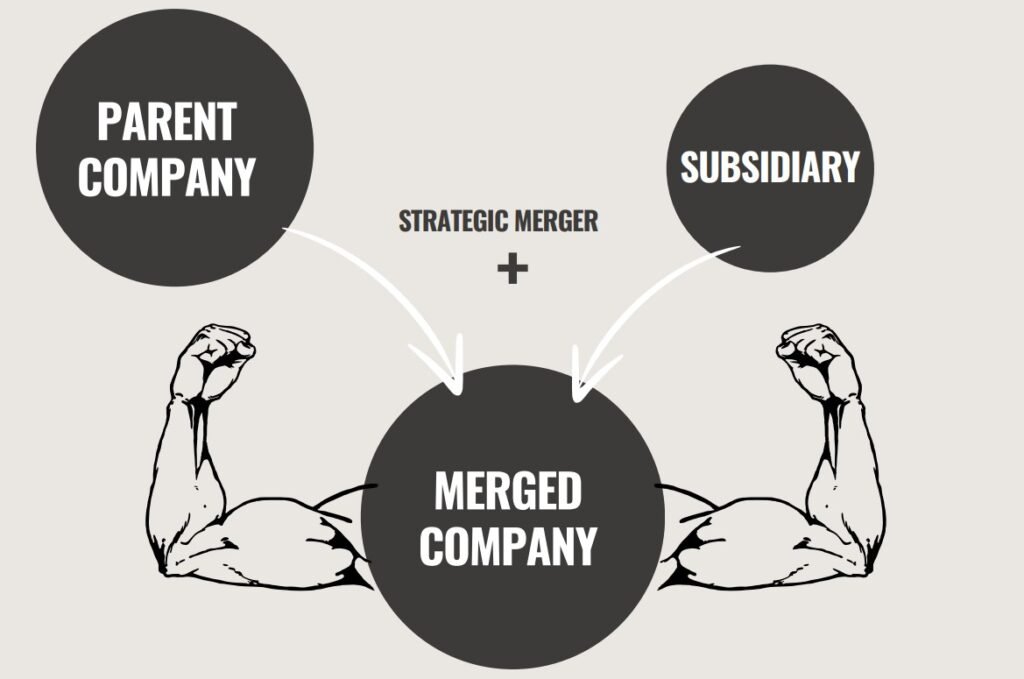

Leverest conducted a comprehensive analysis of the client’s financial health and operational dynamics. This involved a detailed review of the company’s financial statements, debt structure, capital cycle, and market position. Recognizing the limitations of the standalone financials, we explored alternative avenues for credit appraisal. A detailed examination of the parent company’s balance sheet revealed stronger financial metrics that could support the borrowing needs of the subsidiary. Leverest proposed using the parent company’s balance sheet for the credit appraisal of the borrower, along with a corporate guarantee which transformed to a more robust basis for securing a loan.

Strategic Intervention-

Leverest implemented a multi-faceted strategy to address the client’s financial challenges and optimize its capital structure. The key components of this strategy included:

1. Leveraging the Parent Company’s Balance Sheet:

– Credit Appraisal: Leverest proposed using the parent company’s balance sheet for the credit appraisal of the plastic solutions manufacturer. This approach allowed the client to give a consolidated robust financial profile to potential lenders, thereby securing more favourable financing terms.

– Enhanced Creditworthiness: By leveraging the parent company’s financial strength, and corporate guarantee, the manufacturer was able to enhance its creditworthiness, making it more attractive to lenders.

2. Advising a Strategic Merger:

– Merger Planning: Leverest advised the client on a strategic merger with its parent company. This involved detailed planning, including regulatory compliance, stakeholder communication, and operational integration.

3. Securing Term Debt:

– Expedited Process: Leverest utilized its strong relationships with financial institutions to expedite the debt procurement process. This involved negotiating terms, preparing documentation, and coordinating with lenders.

Results-

Leverest’s strategic intervention yielded remarkable results for the client:

1. Enhanced Financials: The merger with the parent company increased the topline from INR 200 crores to INR 375 crores approximately. This not only improved the financial metrics but also provided a more substantial base for future growth and investment.

2. Reduced Cost of Debt: The client’s cost of debt was significantly reduced from the previous range of 12-13%. The improved financial standing and enhanced lender confidence facilitated more favourable loan terms.

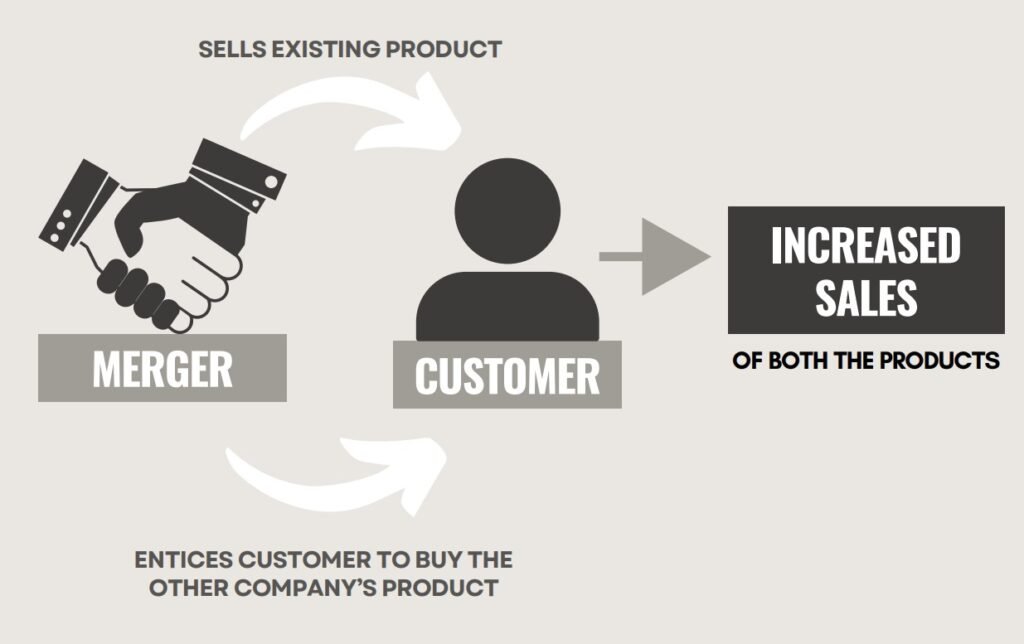

3. Increased Bank Confidence: The revenues of the company increased. Simultaneously, the cost reduced due to economies of scale between the two companies. This resulted in higher EBITDA margins while the fixed finance cost remained the same. Hence, the coverage ratios increased, depicting a strengthened credit service capability of the company.

4. Improved Market Position: The consolidation enhanced the company’s market accessibility and serviceability. The combined entity could now cater to a broader market by reaching out to each other’s already existing market base, leveraging the strengths of both the parent and subsidiary.

5. Expedited Capital Raising: Leverest’s intervention led to the swift procurement of term debt within a short timeframe. The improved financial profile and increased lender confidence facilitated a quick turnaround, providing the necessary working capital to alleviate the capital cycle issues.

Conclusion-

This case study underscores the importance of strategic financial interventions in overcoming capital challenges. Companies with high debt costs and weak standalone financials should consider leveraging parent company resources for credit appraisal. Additionally, strategic mergers can enhance financial stability and improve access to capital. Companies should also focus on optimizing their capital cycle management to ensure efficient cash flow. This involves reducing debtors’ turnover periods and improving creditor management.